It’s Still Not Too Late to Buy Disney Stock as Markets Rally on Tariff Pause

Disney stock (DIS) surged last week after the company reported an impressive set of numbers for its fiscal second quarter of 2025. Thanks to the surge, Disney narrowed down its YTD losses and is now down just under 2% for the year. In this article, we’ll look at Disney’s recent earnings and analyze whether it is too late to buy the entertainment giant now.

Disney Reported Better-Than-Expected Earnings

Like most other U.S. companies, Disney went into the confessional with tepid expectations amid tariff uncertainty. Notably, apart from tariffs, Disney is also battling low tourist arrivals in the U.S. as the President Donald Trump’s immigration rhetoric and polivies have deterred many would-be theme park attendees.

But despite the noise, Disney reported a stellar set of numbers. Its revenues rose 7% in the quarter while adjusted earnings per share (EPS) rose 20% to $1.45, with both numbers easily surpassing analysts’ estimates. The company’s streaming subscriber numbers also came in well ahead of estimates, as well as its guidance.

Moreover, while Disney said that it is watching “macroeconomic developments for potential impacts to our businesses and recognize that uncertainty remains regarding the operating environment for the balance of the fiscal year,” it raised its profit guidance for the year. The company forecast full-year adjusted EPS growth of 16%, which is just about twice its previous guidance.

Disney also announced that it would set up its next theme park in Abu Dhabi in collaboration with Miral Group, which will provide capital for the project. Overall, it was a strong quarterly performance from Disney, and markets rewarded the stock accordingly.

Disney Stock Forecast

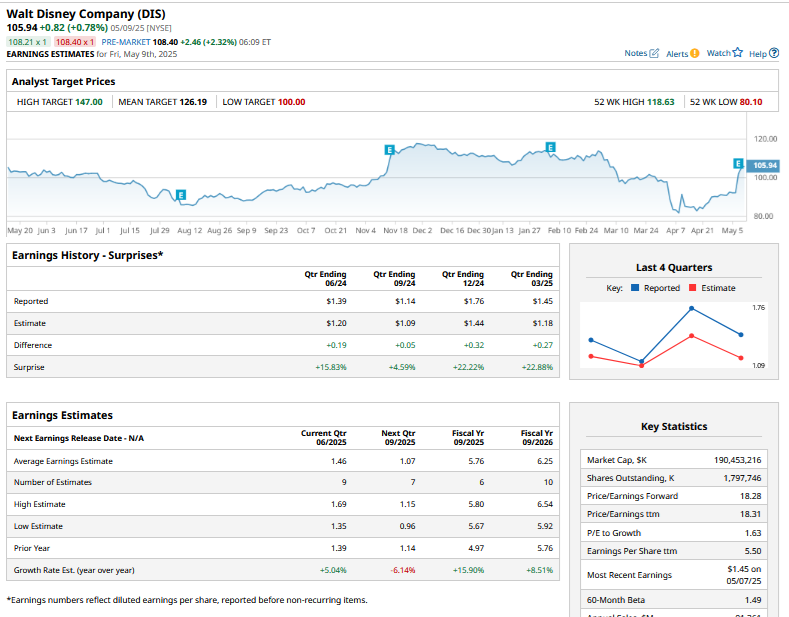

After Disney’s earnings release, several brokerages raised Disney’s target price. Among the prominent names, UBS raised Disney’s target price from $105 to $120 while Morgan Stanley raised its from $110 to $120. However, there were no upgrades or massive target price hikes, which has pretty much been the theme this earnings season. Disney’s mean target price is $126.19, which is 16% higher than its current price. Its Street-high and Street-low target prices are $147 and $100, respectively.

Is It Too Late to Buy Disney Stock?

There are still risks that Disney investors should be cognizant of. While the tariff uncertainty has subsided and there is growing optimism over the U.S. signing more trade deals, the U.S. economy is still expected to slow down this year. Moreover, Disney’s Linear TV business continues to be in a secular decline, and the company is yet to find a successor to CEO Bob Iger, whose contract is expiring next year. However, I believe that it’s still not too late to buy Disney stock as the risk-reward still looks favorable at these levels. Here’s why.

Disney Has Revamped Its Strategy: Ever since Iger’s return in late 2022, Disney has been working on a turnaround strategy under which it is focusing on quality rather than quantity in its movie business. The strategy has paid off well, and Disney’s box office performance has been splendid over the last year.

The importance of Disney’s box office success cannot be understated and goes way beyond the box office contributions to its earnings. In-house, quality movies add to Disney’s streaming content and make the offering even more valuable for subscribers. These also increase Disney’s connection with its customer base, which eventually translates to higher traffic at its theme parks, which are the company’s cash flow engine.

As the company aptly summed in its Q2 letter, “our successful theatrical releases have a multiplier effect across our company, creating franchises and generating long-term value even they’ve left theatres.”

Improvement in Streaming Business: The second key pillar of Iger’s turnaround strategy was pushing for streaming profitability. Disney’s streaming business has turned profitable, and there is a lot of scope for the company to improve its margins even further. Among others, the paid sharing feature and higher ad revenues on the ad-supported plan will help the streaming segment’s profits going forward.

Growth in Parks Segment: Disney has vowed to invest $60 billion in its Parks, which would help maintain the segment’s competitive advantage. Additionally, the upcoming theme park in Abu Dhabi will significantly increase the target market for Disney Parks. The company estimates that 500 million potential customers live within short flying and driving distance from the region, which it described as the “crossroads of the world.”

Finally, Disney has a forward price-earnings (P/E) multiple of 18.28x, which looks quite reasonable. The company has seen a remarkable turnaround over the last couple of years, and I find it worthy of a valuation rerating.

To sum it up, I believe it is still not too late to buy Disney stock, especially as the risk-on trade rolls on amid news of a 90-day tariff pause between the U.S. and China.

On the date of publication, Mohit Oberoi had a position in: DIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.