Is Tesla Stock a Buy, Sell, or Hold After Rare Auto Supplier Acquisition?

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA), the leading American electric vehicle maker, needs no introduction. Led by CEO Elon Musk, the company has global operations.

The last few months have not been easy for Tesla, which is down nearly 30% in the year to date. As the stock continues to face selling pressure, it is now more than 40% below its 52-week high of $488.54.

Rare Deal for Tesla

Tesla is one company that isn’t very active in terms of mergers and acquisitions (M&A). However, it recently closed a deal with insolvent German auto supplier Manz AG. Tesla penned the agreement through its subsidiary Tesla Automation GmbH.

The financial details of the deal are yet to be disclosed.

Tesla will be taking over more than 300 Manz employees along with some movable assets from Manz’s Reutlingen plant.

For Tsela, this seems to be a strategic move as it continues to invest more in its automation technology. It has continued to add automation capcaity Germany despite a slump in European sales.

Tesla’s senior automation director stated “We are gaining qualified employees with a high level of expertise in high-tech mechanical engineering. The Reutlingen site is an ideal complement to the continued successful implementation of our global automation projects in the Tesla Group. We are very pleased to be realizing future innovations there.”

Tesla’s Recent Quarterly Results

Tesla reported its fourth-quarter results on Jan. 29. The company posted a profit of $2.32 billion, translating to a profit of $0.73 per adjusted share. The figure missed Wall Street’s $0.75-per-share expectations. The company generated total revenue of $25.71 billion during the quarter, again falling short of analysts’ $27.5 billion estimate.

During the quarter the company maintained an operating margin of 6.2%, down from 8.2% reported in the same quarter last year. Its gross margin also downgraded to 16.3% from 17.6% posted in the previous year. The company had a free cash flow margin of 7.9%, in line with last year’s figure.

Additionally, the company delivered a total of 495,570 vehicles in the fourth quarter, missing estimates of 503,106. Throughout 2024, its deliveries totaled to 1.79 million vehicles, also missing estimates.

Tesla plans to launch its unsupervised, full self-driving capability in Austin, Texas this year along with its fleet of robotaxis. Bulls argue that its entrance into the robotaxi market will provide fresh revenue streams for the company.

Should You Buy TSLA Stock Now?

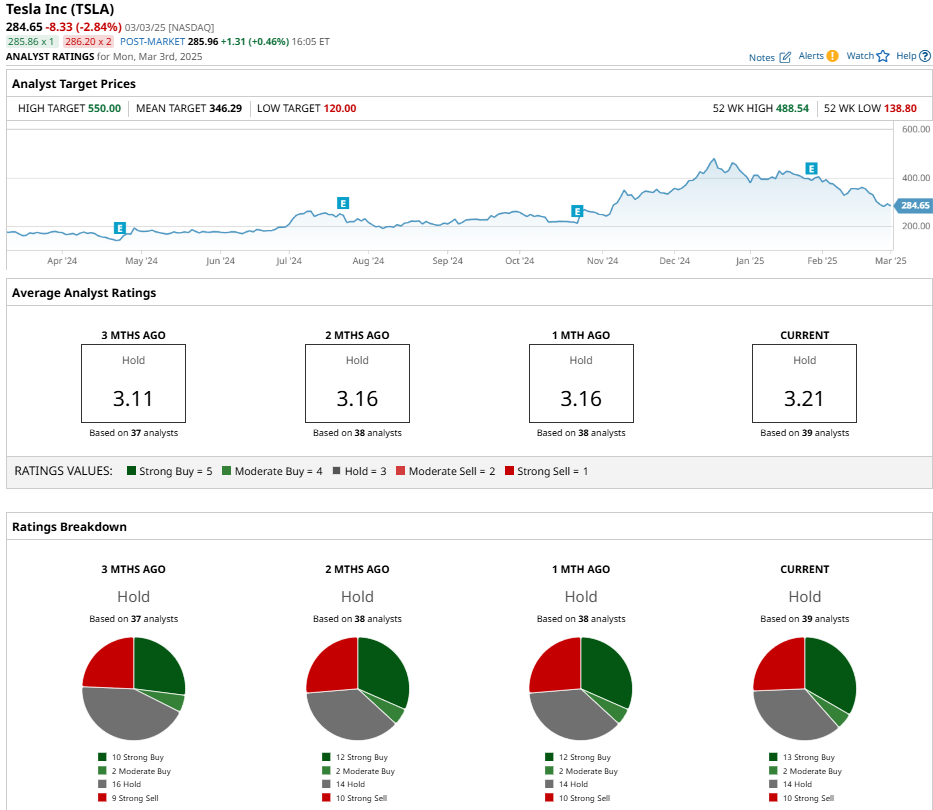

Tesla stock was one of the top picks ahead of the November presidential election, but since the start of 2025, the stock has endured a difficult time. Analysts share the sentiment with a consensus “Hold” rating alongside a mean price target of $346.29, reflecting upside potential of 21%.

The stock is being monitored by 39 analysts in total and has received 13 “Strong Buy” ratings, two “Moderate Buy” ratings, 14 “Hold” ratings, and 10 “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.